The Discounted Cash Flow (DCF) model accounts for tenant rollover risks in multi-tenant properties by incorporating several key factors:

Lease expiration modelling: The DCF model projects future cash flows based on individual tenant lease terms, allowing for staggered lease expirations common in multi-tenant properties. This helps identify periods of higher rollover risk.

Probability-based renewal assumptions: The model can assign renewal probabilities for each tenant, weighting rent at turnover based on these probabilities. For example, if there’s a 75% chance of renewal, the new rent might be calculated as 75% of the tenant’s current rent plus 25% of the market rent.

Vacancy and downtime projections: The model accounts for potential vacancies and downtime between leases, critical factors in rollover risk assessment.

Market rent assumptions: DCF incorporates projections for market rents, allowing for adjustments when leases expire, new tenants are acquired, or existing ones renew.

Tenant improvements and leasing costs: The model can factor in expenses associated with tenant turnover, such as improvements required for new tenants or leasing commissions.

Sensitivity analysis: DCF models often include sensitivity analyses to evaluate how changes in renewal rates, market rents, or vacancy periods affect overall property value.

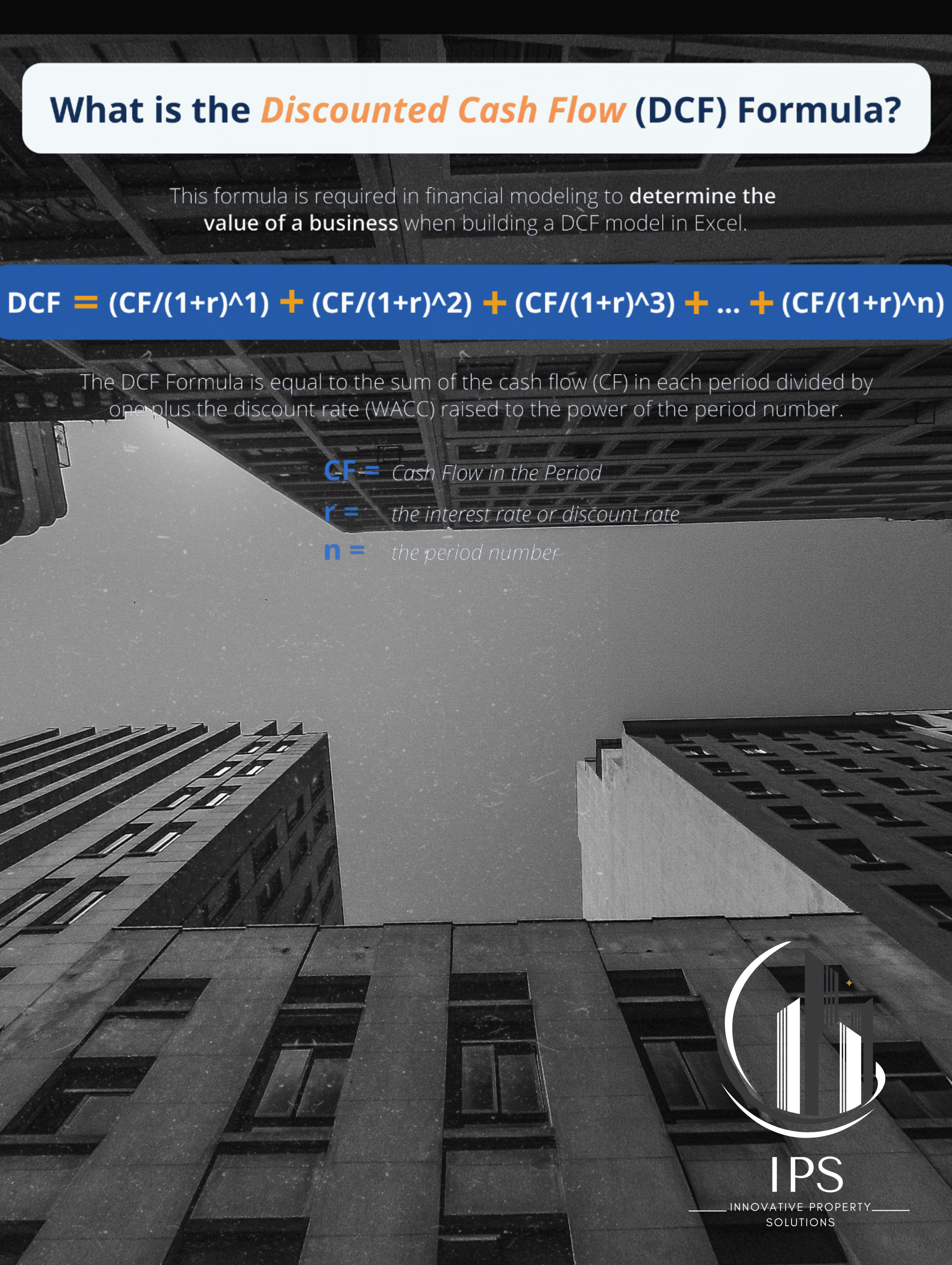

Cash Flow with the DCF Model: By projecting cash flows over time, the DCF model highlights periods of potential income volatility due to multiple lease expirations.

Risk-adjusted discount rates: Higher rollover risk can be reflected in the discount rate used in the DCF model, with riskier cash flows discounted at a higher rate.

By incorporating these elements, the DCF model provides a comprehensive view of how tenant rollover risks can impact a multi-tenant property’s value over time. This allows investors to make more informed decisions and mitigate these risks through strategic leasingand property management.

By incorporating these elements, the DCF model provides a comprehensive view of how tenant rollover risks can impact a multi-tenant property’s value over time. This allows investors to make more informed decisions and mitigate these risks through strategic leasing and property management.